Letters of Credit

Key Benefits

key benefits

For the importer:

The ability to monitor and reduce the randomness

It can make an accurate estimate of the cash flows, and the price of goods

We may agree on more favorable situations

It can be granted a credit to have LC content

Although the exporter:

The pay limits, changing their bank

Improving competitiveness

Forecast cash flow

The exporter may cost savings to other credit insurance

Local guide and procedures

And 'it eliminated the risk of the national bank of the exporting country

Important Features

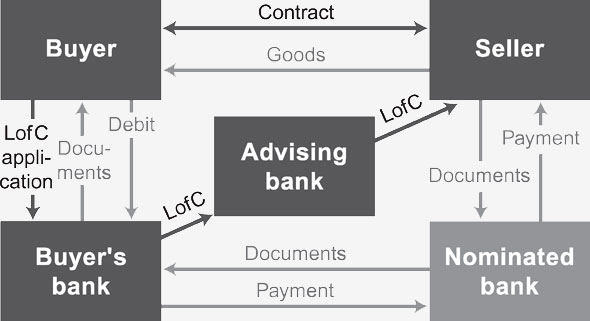

The LC issued by banks

credit conditions and currency of payment may agree

You can monitor with a loan from a bank of the exporting country

Unknown date of payment and revenue

LC may provide for the payment, or the content (deferred payment of, say, 30, 60, 90 or more)

The customer's bank LC and also asks for clarification of the terms

credit conditions, currency prices and payment can be established

The product's characteristics change depending on the location. It invites you to contact your local branch for more information.